Credit Analysis & Research (CARE) has upgraded the long-term rating of MMTC to A+ from AA for Rs 2 billion long-term bank facilities. CARE reaffirmed 'A1+' ratings to the company's short-term bank facilities of Rs 54.50 billion.

Credit Analysis & Research (CARE) has upgraded the long-term rating of MMTC to A+ from AA for Rs 2 billion long-term bank facilities. CARE reaffirmed 'A1+' ratings to the company's short-term bank facilities of Rs 54.50 billion.

CARE has upgraded the long/ short-term rating of the company to A+/ A1+ from AA/ reaffirmed A1+ for Rs 58.75 billion long-term bank facilities.

CARE has upgraded the long/ short-term rating of the company to A+/ A1+ from AA/ reaffirmed A1+ for Rs 58.75 billion long-term bank facilities.

The revision in the ratings takes into account the weakening of the net-worth position of MMTC on account of the repeated provisioning made against amounts recoverable from debtors in FY13 (refers to the period April 1 to March 31) pertaining to bullion transactions at MMTC's regional offices and in H1FY14 pertaining to dues recoverable from National Spot Exchange (NSEL).

Furthermore, the ratings also take into account the weakened financial profile and stretched liquidity position of MMTC's associate, Neelachal Ispat Nigam (NINL), which might necessitate the higher operational and funding support from MMTC going forward. The ratings continue to be constrained by the low profitability margins and moderate increase in receivables which might necessitate the higher working capital borrowings in the medium term.

The ratings, however, continue to take into account MMTC's position as the largest international trading house in India, predominant ownership by the Government of India (GoI), comfortable capital structure as well as long and established track record of trading in diverse commodities.

Going ahead, the ability of MMTC to strengthen the control systems, improve the profitability while efficiently managing its working-capital requirements, extent of support provided to NINL and other subsidiary/associates and its impact on MMTC's financial risk profile shall be the key rating sensitivities.

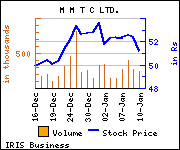

Shares of the company gained Rs 0.3, or 0.59%, to settle at Rs 51.45. The total volume of shares traded was 118,474 at the BSE (Monday).